Why We Need to Near Source Electronic Components

- posted by: Shyam Chandran

- No Comments

Why we need to Near Source Electronic Components

The past two years have offered some harsh lessons to all in the PCBA industry on the value of inputs. For a long time, the cost paid was the only consideration. The supplier might be located on the other side of the world, but if the cost was marginally lower, the choice was clear. But the pandemic changed all that. The cost of logistics / transport that used to be negligible ballooned beyond expectations. And for some parts – no matter what cost we were willing to pay – the availability just did not exist.

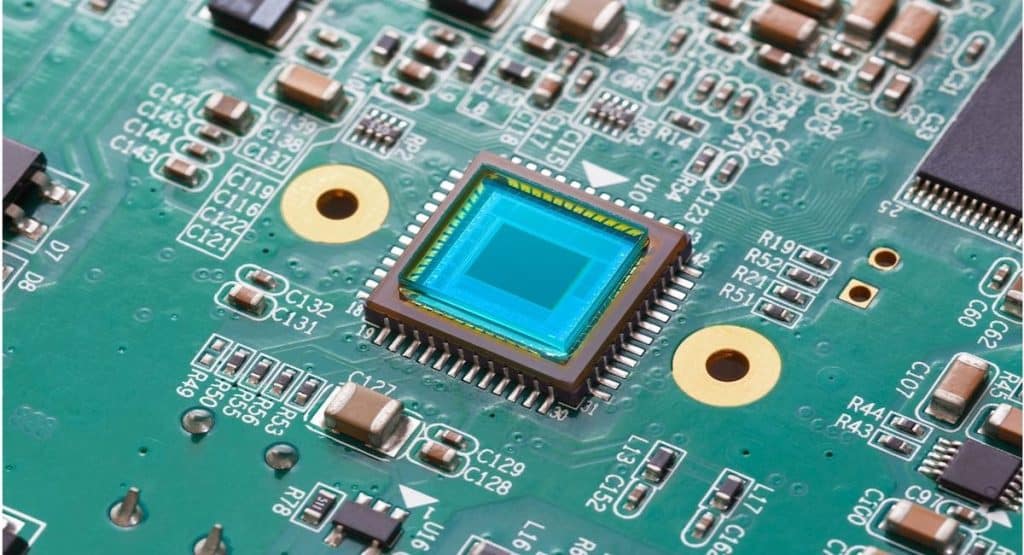

PCB Assembly

In India, we import more than 90 percent of the components required for assembling PCBs locally. These imports come from 4 countries – China, Taiwan, Vietnam, and Malaysia. A break down at one source country, as we saw in 2020 and 2021, drives up the cost of doing business for all.

Here’s our experience with supply trends for some of our major inputs:

Bare PCBs:

Bare PCBs are the stronger point in our supply chain. We have seen reliable suppliers of Bare PCBs based in Tamil Nadu and in Gujarat. We (and many of our customers) have been able to source Bare PCBs in the past 18 months with no major issues. Supply lead times have remained consistent and price increases have stayed within tolerable limits.

Assembly Machinery:

Machinery needed for PCBA is mostly manufactured outside India by majors like Yamaha, Fuji, Panasonic, and Siemens. While prices have stayed stable, lead times have increased considerably. What used to be available in 4 weeks now takes 4 months to get delivered. We’ve had to plan and order earlier than ever before for any capacity enhancements or repairs and replacements.

Other Components / Services:

Integrated Circuits (IC’s), their component resistors, capacitors et al, solder paste etc. are mostly imported and have all seen prices and lead times zoom up. 52 weeks is now the new normal! Companies like Micron, TI, Cypress, Infineon, Latis, NXP have factories based in China, Taiwan, Malaysia, and Indonesia. When supply and manufacturing centers were shut and major ports slowed down, component shortages have visibly hit every industry from automotive to computers and mobile phones. Even stocks held by major distributors Avnet, Future, Arrow, or online suppliers like Digikey, and Mouser could not tide the industry over for long.

This is the area where India needs to attract investment and build manufacturing capacity.

What Next:

The government has already recognised the need for building an electronics components manufacturing ecosystem. It is doing its part by offering Production Linked Incentive programs and other sops to encourage manufacture of components in India. It is now up to us in Industry to pick up the challenge and partner in building a strong local eco-system for components.