Modern manufacturing practices pay close attention to their environmental impact. Failure to do so has legal and regulatory implications as well as marketing ones: suppliers’ ‘green’ credentials are frequently a criterion for selection.

The electronics industry – and the PCB industry in particular – uses many metals and processes that create large quantities of ecologically harmful waste. Some metals are dangerous if not disposed of properly, and many that can be reused are often squandered in landfills due to poor waste management practices.

Better Waste Management Practices are the need of the hour

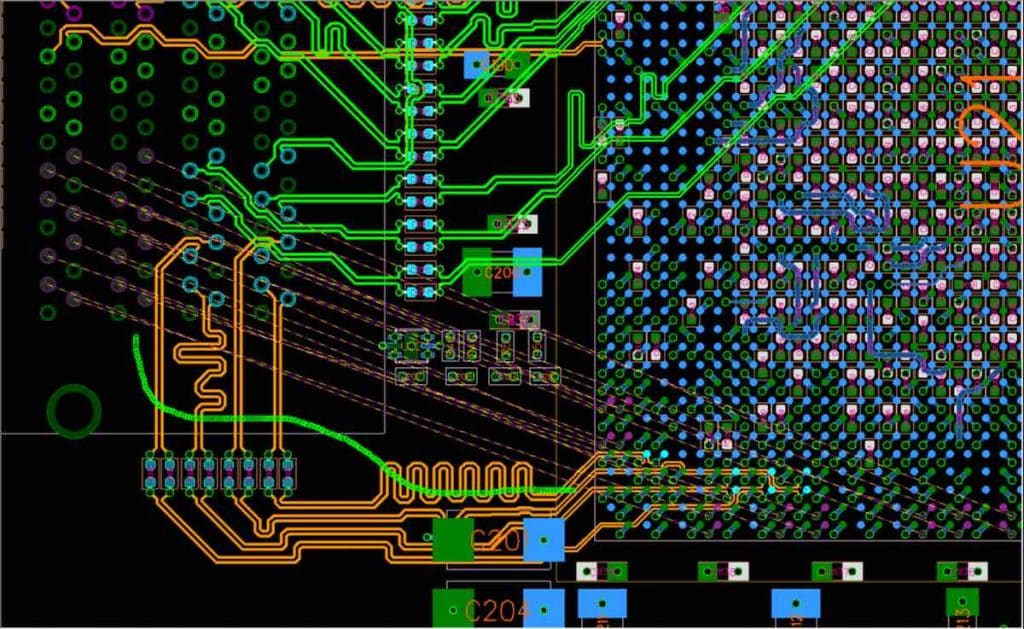

Waste in the PCB industry

A number of materials go into the assembly of a PCB. Most PCBs use resin epoxy, phenolic resin, fibreglass and copper foil. Depending on the complexity of the circuitry in the design, metals including copper, aluminium and iron, and several alloys, may be used. At the end of its life, a PCB that is discarded means those metals and alloys go to waste.

On average, a PCB contains approximately 70% non-metallic and 30% metallic material: organic materials, chemical residuals, heavy metals and high-grade precious metals including palladium, silver, gold and copper. It is estimated that up to 7% of the world’s gold supply may be found in e-waste.

But it is not just the product itself that contains potentially wasted value. A great deal of waste is generated during the manufacturing process itself. For example, during production a PCB must be rinsed several times, leading to water contamination by chemicals and metals, and the release of some acidic emissions into the air.

In February 2003, the European Union issued the Restriction of Hazardous Substances Directive, or RoHS. This directive states that PCB manufacturers wishing to operate in or sell to EU entities may not use six hazardous substances in any stage of their production process – lead, mercury, cadmium, hexavalent chromium, and the fire retardants polybrominated biphenyls and polybrominated diphenyl ether. As the EU is a large and influential market, over the years, PCB production around the globe has begun to comply with the RoHS regardless of where the customer is.

Also in 2003, the first WEEE (Waste Electrical and Electronic Equipment) Directive was introduced, regulating the recycling of electronic waste. Under WEEE, companies that manufacture, distribute or sell electrical and electronic equipment have an obligation to treat it responsibly.

The WEEE became more stringent in 2008 and the RoHS in 2011, increasing the amount of e-waste that is required to be treated and reducing the amount that can be disposed of.

How can waste be reduced?

There are several methods by which PCB manufacturers can address the challenge of managing their waste and minimizing their environmental impact.

Product substitution.

Several alternatives may be substituted for harmful items, especially for supplementary processes like packaging, where sustainable materials are available, which can make an immediate impact on the quantum and composition of waste, and which are relatively easily to obtain and adopt.

Replacement of hazardous materials.

In advanced manufacturing, new techniques, tools and materials are being introduced all the time. For example, when cleaning and preparing PCB surfaces, changes to the materials used, the safety precautions taken and the processes themselves can yield significant results. By using abrasive cleaning and non-chelated materials, manufacturers can reduce the amount of hazardous waste produced. A cascade cleaning system cuts down on the generation of nitric acid as a waste product. It should be noted that cascade systems are not new – for several decades, they have been used to clean machine parts in the heavy electrical industry. Customizing cascade systems for PCB manufacturing is a logical next step.

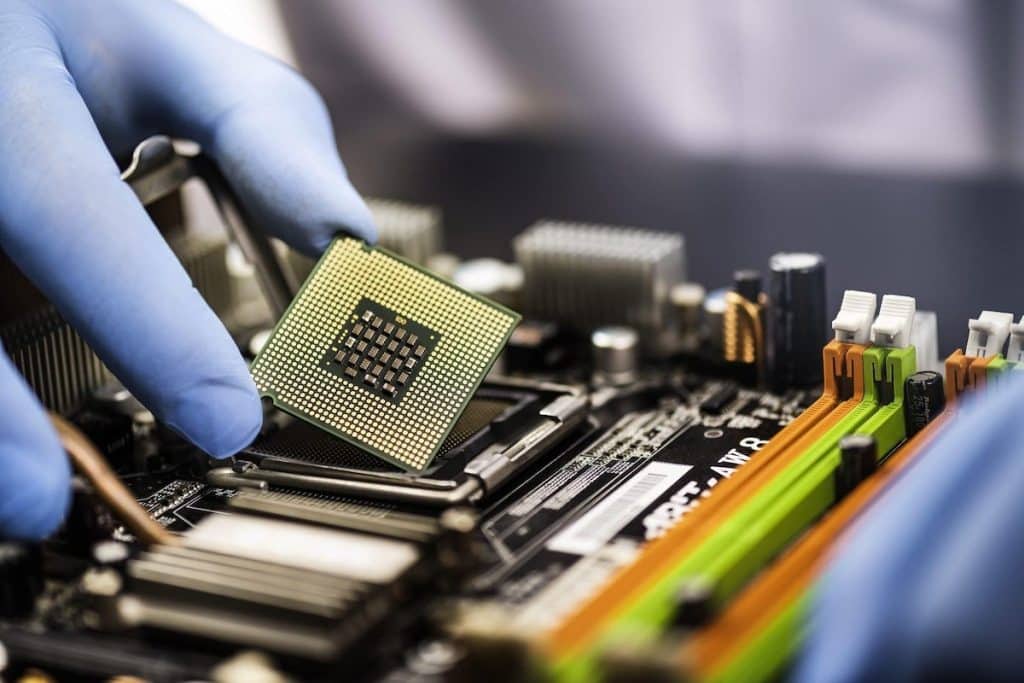

Material reuse or recycling.

Some of the materials used in the production of a PCB can be put back into the production process. Copper from the edge, tin and lead-tin from the solder dross are examples of this. By reusing parts, the process also uses less water. Copper oxide can be used to reduce the reliance on copper hydroxide, which is harmful to the human respiratory system.

Material recovery and segregation.

By joining in or setting up a well-thought-out recycling process, manufacturers can turn waste back into raw material, or supplement their earnings by selling their recovered materials to other industries. Alloys and metals are valuable and can be reused several times, reducing the amount of waste generated and the PCB manufacturer’s dependence on being able to source new materials on time and at the right price.

Traditional PCB recycling involves dismantling the boards, crushing them and physically separating them using magnetic or high-voltage electrostatic methods. This approach is relatively cheap and enables the recovery of metallic components, though it does not solve the problem of segregating heavy metal elements from high-grade precious metals.

Thermal or chemical recycling can obtain purified metals, is much more efficient and has the potential for a much greater economic return. However, the high processing temperatures or high-pressure requirements can cause hazardous fumes, thus creating a new problem while resolving the existing one.

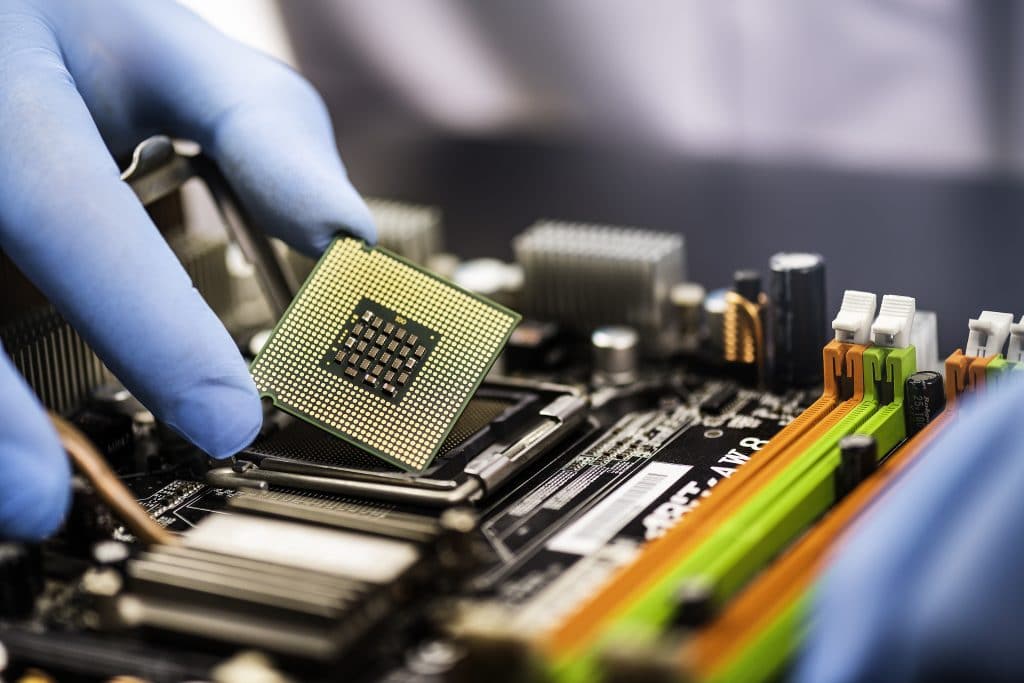

Podrain has tied up with a reliable, pollution control board certified partner for waste disposal. We also return materials and components (unused or even partially working) to our customers so that they can be reused at their end.

We value sustainability and even if we move to an inventory led model we will hope to find solutions that will continue to keep our manufacturing sustainable.